Growth of the Group’s own retail business online and offline via omnichannel approach

Group’s own retail business expanded by omnichannel offerings

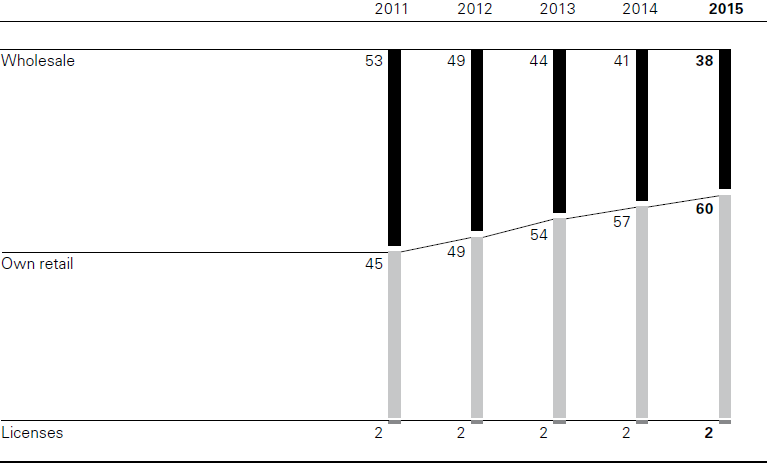

Over the past few years, HUGO BOSS has comprehensively realigned its business model to the requirements of the Group’s own retail business. By expanding this distribution channel, the Group is able to present and sell its brands and collections to optimum effect without sacrificing its established wholesale business. HUGO BOSS is responding to growing customer expectations of seamless cross-channel shopping and brand experiences by stepping up its omnichannel activities. The Group assumes that the share of sales accounted for by its own retail business will continue to increase. In particular, it plans to achieve an annual average increase in comp store sales in the mid single digits. On top of this, new openings and takeovers will help to ensure that the Group generates at least 75% of its sales from its own retail business in 2020 (2015: 60%).

Sales by distribution channel (in %)

Further expansion of store network

The Group continues to see opportunities for increasing its global market penetration by opening about 10 to 15 new stores each year. Given the breadth and quality of its range, HUGO BOSS is confident of being able to manage larger stores than in the past profitably. In this connection, the main focus will be on expanding the portfolio in metropolitan regions, which shape brand perception and account for the bulk of the global luxury goods business.

Continuous elevation of store portfolio by takeovers and renovations

In addition to opening new stores, the Group is also considering taking over stores that are currently operated by franchise partners, depending on the attractiveness and growth prospects of the relevant market. The Group’s own management of shop-in-shops currently run by wholesale partners also offers good opportunities to improve the attractiveness of the brand presentation and tap additional sales and earnings potential. However, the commercial significance of new openings and takeovers will decline compared with earlier years, while renovation of existing stores will become significantly more important. Stores are generally renovated after around five years, frequently leading to a substantial increase in economic performance. Retail areas which fall short of the Group’s profitability targets in the medium or long term will be closed or, in the case of shop-in-shops, returned to the retail partner.

Omnichannel offerings increasingly make shopping a “noline” experience

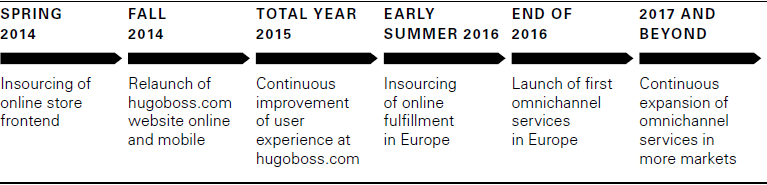

Over the past few years, HUGO BOSS has boosted its sales significantly in both bricks-and-mortar retail and in its online business. Moving forward, it will link the two channels more closely to offer consumers a seamless and integrated brand and shopping experience. Following the takeover of the online store front end from the former fulfillment partner and the relaunch of the hugoboss.com website in 2014, the focus in 2015 was on improving services and features in order to optimize the online shopping experience and the ease of use of the store step by step. In the next twelve months, the Group will upgrade the content and look of the hugoboss.com website substantially and make it the central hub for all of the brand’s digital activities. The purpose of this is not only to boost online sales, but also to emotionalize the brand and tempt customers into the stores. To this end, the Group plans to expand omnichannel offerings such as “click & collect” and the ability to order sold-out sizes or products online directly in-store. In order to make this happen, HUGO BOSS will take over substantial parts of the e-commerce value chain in Europe, notably in the areas of IT and logistics, in the early summer of 2016. The Company assumes that in the medium term insourcing will have a favorable impact on profitability.

Measures for implementing an omnichannel business model

IT innovations and sector-leading logistics support retail management

A high-performance SAP-based IT structure supports retail management within the Group. Introduced in 2015, the retail merchandise planning (RMP) system provides a fully integrated view of stock flows, thus permitting system-based planning oriented directly to the demand of end consumers. The retail assortment planning (RAP) system used for the first time in the development of the Fall 2016 collection optimizes the product offering based on the capacity of individual stores, the characteristics of the location in question and the individual product life cycle. Finally, a powerful logistics infrastructure ensures timely and accurate delivery to the Group’s own points of sale as well as wholesale partners. In operation since 2014, the flat-packed goods distribution center located close to the Group’s headquarters has particularly boosted the speed of the supply chain in Europe and improved the efficiency of key handling processes.

Wholesale still an important distribution channel despite declining share of sales

Based on its established customer relationships in the premium and luxury apparel segment, built over decades, and its brand attractiveness, the Group is confident that it can continue to offer its department store partners a convincing product range, best-in-class service and a high level of delivery reliability in the future, and thereby increase its market share. In addition, the Group will expand its business with specialist online retailers selectively and setting the bar high for the quality of the brand presentation. This will leverage economies of scope and provide access to new consumer groups. However, takeovers will put pressure on sales growth in the wholesale business. Moreover, HUGO BOSS assumes that its business with specialist stores, which are frequently owner-operated, will contract. All told, it therefore expects a decline in the share of Group sales contributed by wholesale.