Key performance indicators

Key performance indicators of the HUGO BOSS Group

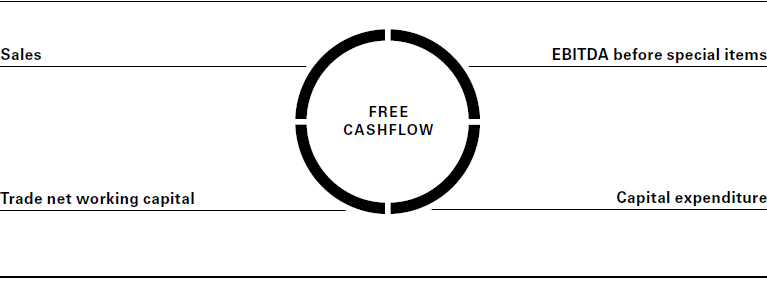

Focus on increasing free cash flow in the long-term

To increase the enterprise value, the Group focuses on maximizing free cash flow over the long term. Maintaining positive free cash flow on a lasting basis secures the Group’s financial independence and its solvency at all times. Increasing sales and operating income, defined as EBITDA (earnings before interest, taxes, depreciation and amortization) before special items, are the main levers for improving free cash flow. Strict management of trade net working capital and value-oriented investment activities also support the development of free cash flow.

|

Cash flow from operating activities |

+ |

Cash flow from investing activities |

= |

FREE CASH FLOW |

The Group’s most important performance indicators are sales and EBITDA before special items

As a growth-oriented company, HUGO BOSS attaches particular importance to profitably increasing its sales. All activities to raise sales are gauged by their potential to generate an increase in adjusted EBITDA and the adjusted EBITDA margin (ratio of earnings to sales) before special items in the long term. EBITDA was chosen as the most important performance indicator as it is a key driver of free cash flow. Productivity increases in the Group’s own retail business are seen as the main lever for increasing the EBITDA margin. In addition, the Group enhances the efficiency of its sourcing and production activities and optimizes its operating expenses to ensure that they do not outpace sales growth.

Management of the Group companies is directly responsible for obtaining profitable business growth. Consequently, part of the total remuneration of management of the independent distribution companies is variable and tied to the realization of targets for sales and EBITDA before special items as well as other indicators of relevance for cash flow.

Managing efficient use of capital through trade net working capital

Owing to the low-capital-intensive nature of HUGO BOSS’ business model, trade net working capital is the most important performance indicator for managing efficient use of capital.

|

Inventories |

+ |

Trade receivables |

− |

Trade payables |

= |

TRADE NET WORKING CAPITAL |

Management of inventories as well as trade receivables is the responsibility of the central operating functions and distribution units. Moreover the central operating functions are responsible for the management of trade payables. These three components are managed using the indicators days inventories outstanding, days sales outstanding and days payables outstanding, which are partially factored into the variable remuneration of management of the central functions and distribution units. Furthermore, the ratio of trade net working capital to sales is set as one of the Managing Board’s targets and is reported as part of the planning process and monthly reporting. A specific approval process has been implemented for the collection-based purchase of inventories for the Group’s own retail business in the interests of additional inventory optimization. In addition to future sales quotas, this process also takes account of projected discounting levels and future expected sales growth.

Capex focuses on the Group’s own retail business

The potential value added of proposed investment projects is assessed taking into account the relevant cost of capital. Expanding the Group’s own retail business is currently the focus of the Group’s investment activity. With this in mind, a specific approval process was established for projects in this area. Apart from a qualitative analysis of potential locations, this also includes an analysis of each project’s present value.

|

2015 |

2014 |

Change in % |

|||

Sales |

2,808.7 |

2,571.6 |

9 |

|||

EBITDA before special items |

594.1 |

590.8 |

1 |

|||

Trade net working capital |

527.6 |

503.0 |

5 |

|||

Capital expenditure |

220.3 |

134.7 |

64 |

|||

Free cash flow |

207.6 |

268.4 |

(23) |

Free cash flow is primarily used to finance the dividend distribution

The free cash flow generated by the Group is primarily used to finance the dividend distribution. The Group’s dividend policy provides for 60 – 80 % of the Group’s net income to be distributed to the shareholders. Any liquidity available over and above this is used to further reduce financial liabilities or retained as a cash reserve. The Group analyzes its balance sheet structure at least once a year to determine its efficiency and ability to support future growth and to simultaneously provide sufficient security in the event that business performance falls short of expectations. In addition to net financial liabilities, this analysis also takes account of future rental obligations.