Assessment of the risk situation by Management

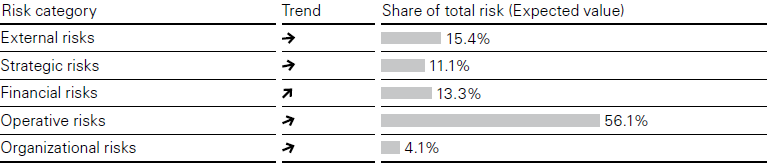

The individual risks are aggregated using two alternative methods to obtain the most accurate possible picture of the HUGO BOSS Group’s total risk position. First, an addition of all the expected loss values within the five risk categories described above shows that the greatest exposure continues to come from operational risks. Compared to the last report produced at the end of fiscal year 2014, the total risk position has risen moderately overall. This development can be explained by the global uncertainties that have increased perceptibly in 2015.

Development and composition of total risk exposure

Risk aggregation using Monte Carlo simulation

Second, using a Monte Carlo simulation method, the probability distributions of all identified risks are aggregated to form a single probability distribution for a possible total loss. A large, representative number of conceivable risk-dependent future scenarios is calculated by random selection. In these scenarios, certain risks occur and others do not in accordance with the probabilities of their occurrence. By this means, not only average loss amounts, but also maximum annual loss values within randomly selectable confidence intervals can be determined across all simulation runs. These value-at-risk indicators are compared to the enterprise’s equity to assess its risk-bearing capacity. The result of this analysis shows that the HUGO BOSS Group’s equity is in excess of all simulated risk-dependent loss values, even within the tightest confidence intervals.

On the basis of the information that is continually recorded as part of the risk management process both by the parent Group and the subsidiaries worldwide and evaluated by the central risk management team, the Managing Board currently assumes that based on the information available all individual and aggregated risks can be classified as manageable. Interdependencies or common causes that could simultaneously trigger several risks also do not endanger the continued existence of the Group as a going concern.

The main risks to which HUGO BOSS is exposed in fiscal year 2016 are described in detail in the following. The risks discussed concern both the operating segments and the corporate units of the HUGO BOSS Group. In general, it is possible that additional latent risks or risks that are currently estimated as immaterial may also adversely affect the Group’s development in the future to more than the stated extent. Irrespective of the measures introduced to manage the identified risks, entrepreneurial activity is always exposed to residual risks that cannot be entirely avoided even by a modern risk management system such as that implemented in the HUGO BOSS Group.